Introduction

A recent Density study revealed that 71% of office spaces could support four times their actual usage, highlighting the critical importance of space management in modern organizations. Smart property management transforms physical environments into strategic assets that drive organizational success and facility management excellence.

In this article, we'll explore essential space management practices and their impact on modern organizations. You'll learn about the benefits of successful space management, discover software to manage workplace environments, and understand implementation strategies and emerging trends in space management. We'll also examine practical metrics for measuring success and methods for overcoming common challenges in space management initiatives.

What is Space Management?

Space management is the process of optimizing an organization's physical spaces through tracking, analysis, and planning. It involves monitoring space utilization data, analyzing usage patterns, and developing space planning strategies to ensure every square foot serves its intended purpose effectively.

Consider a corporate office where some departments have excess space while others are cramped. Efficient space management makes tracking space utilization metrics possible, allowing organizations to optimize their use of available space through data-driven decisions. This approach provides visibility into space usage, helping transform underutilized areas into productive spaces while creating a better workplace experience. Strategic real estate and facilities management helps optimize space and create balanced, efficient working environments that support organizational goals while ensuring optimal use of space and minimizing waste.

Benefits of Effective Space Management

Enhancing Employee Productivity

Space management significantly impacts workplace efficiency by creating environments that support both collaborative and focused work. Through strategic workspace design, organizations can foster improved collaboration while reducing distractions that hamper productivity.

Well-designed space management involves incorporating key workplace elements that prioritize employee wellbeing through ergonomic furniture, proper lighting, and designated quiet zones. These features combine to create a work setting that enhances focus, promotes creativity, and supports various working styles.

Reducing Operational Costs

Space and asset management plays a crucial role in reducing operational expenses, particularly in real estate costs – typically the second-largest expense after salaries. Through data-driven space allocation and utilization analysis, organizations can identify and eliminate wasted space.

The rise of hybrid work models has created new opportunities for space management optimization. By implementing hot desking and flexible seating arrangements using space management software, companies can significantly reduce their physical footprint while maintaining productivity. In the Asia-Pacific region, for example, a major enterprise used desk-level sensors and heatmaps to identify and relinquish underutilized areas across multiple floors and business units, achieving annual savings of $3 million.

Increasing Employee Satisfaction

A successful space management model directly contributes to employee satisfaction by creating comfortable, flexible work environments. Modern space management strategies prioritize ergonomic design and diverse workspace options, allowing employees to choose settings that best suit their work style.

The implementation of adaptable work arrangements through strategic space management demonstrates an organization's commitment to employee wellbeing. This adaptability, combined with thoughtful design and comfortable amenities, helps attract and retain top talent while fostering a positive workplace culture.

Key Tools and Components of a Space Management System

Space Planning Fundamentals

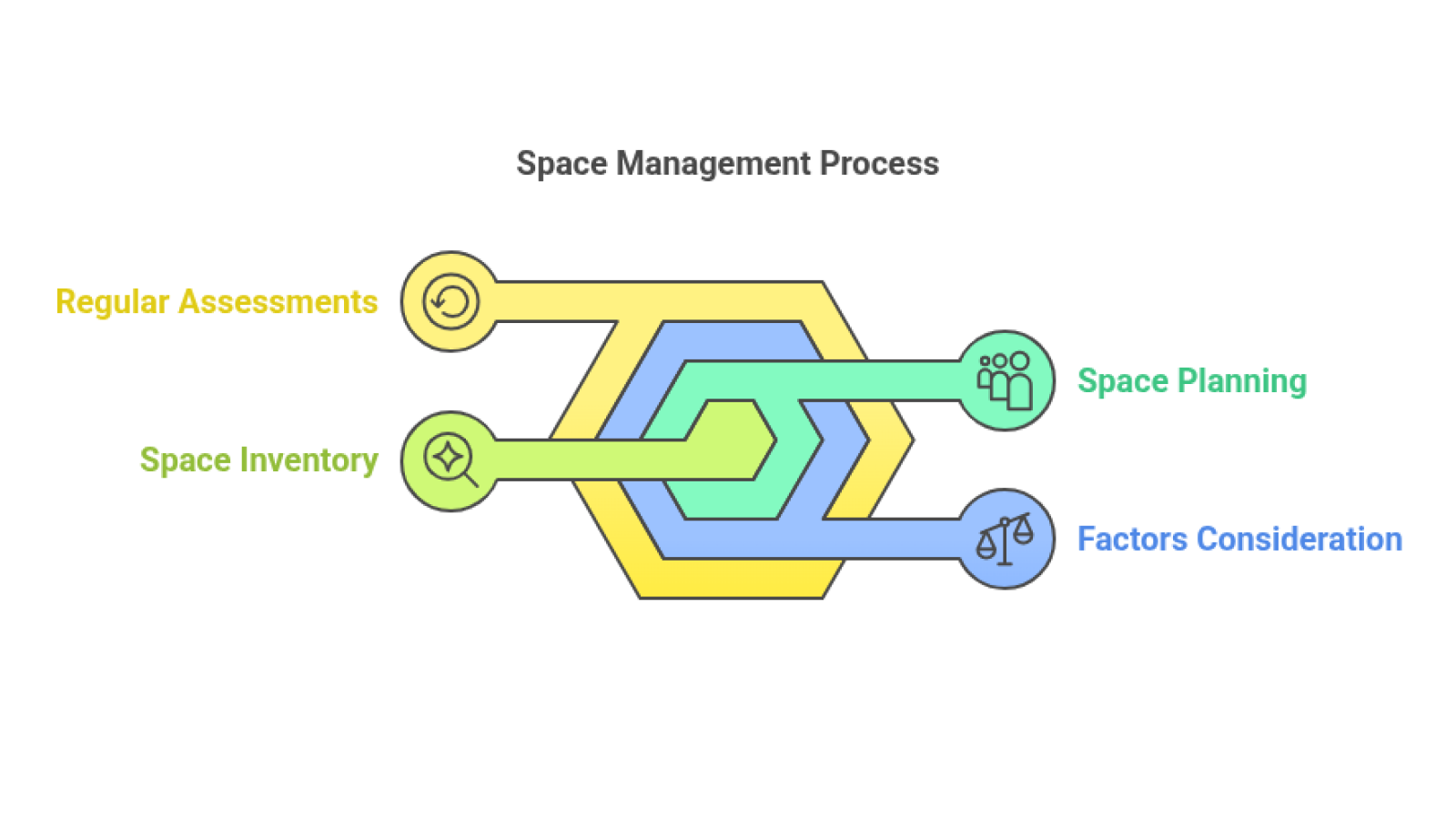

A robust space management system begins with a comprehensive physical space inventory and space planning that considers both physical attributes and user needs. This process involves analyzing structural elements, understanding workflow patterns, and identifying opportunities for optimization.

The planning process must account for factors such as how much space is needed, occupancy requirements, activity patterns, and technology needs. Success relies on regular assessments to ensure the space continues to meet evolving organizational requirements.

Space Management Software Features

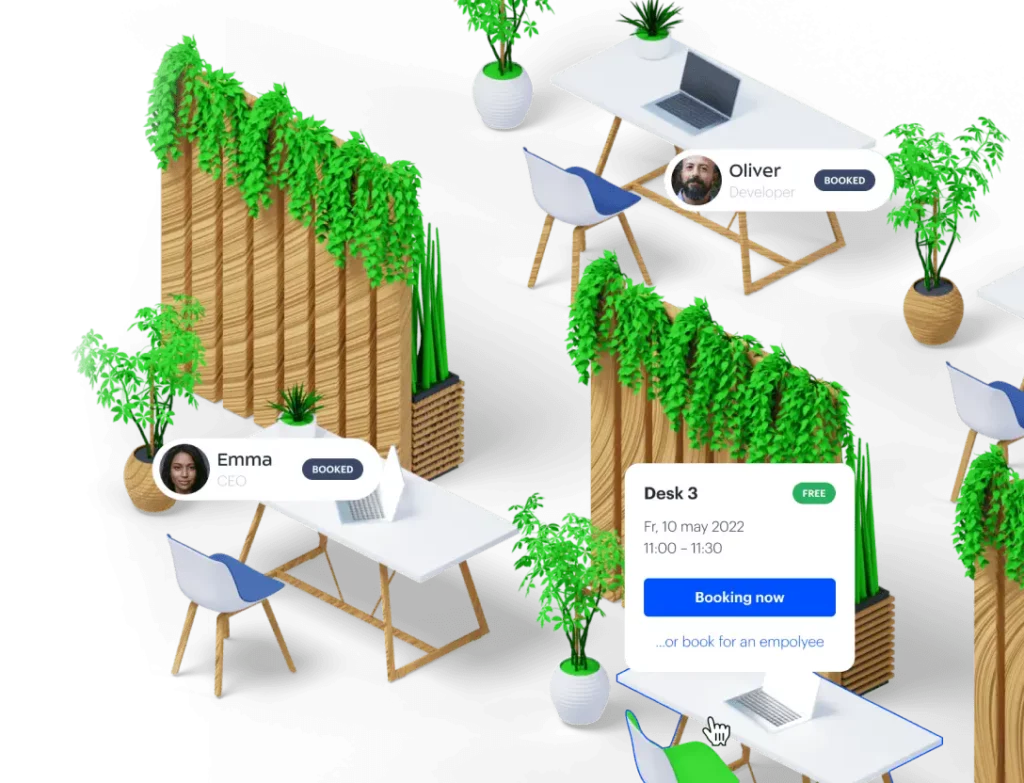

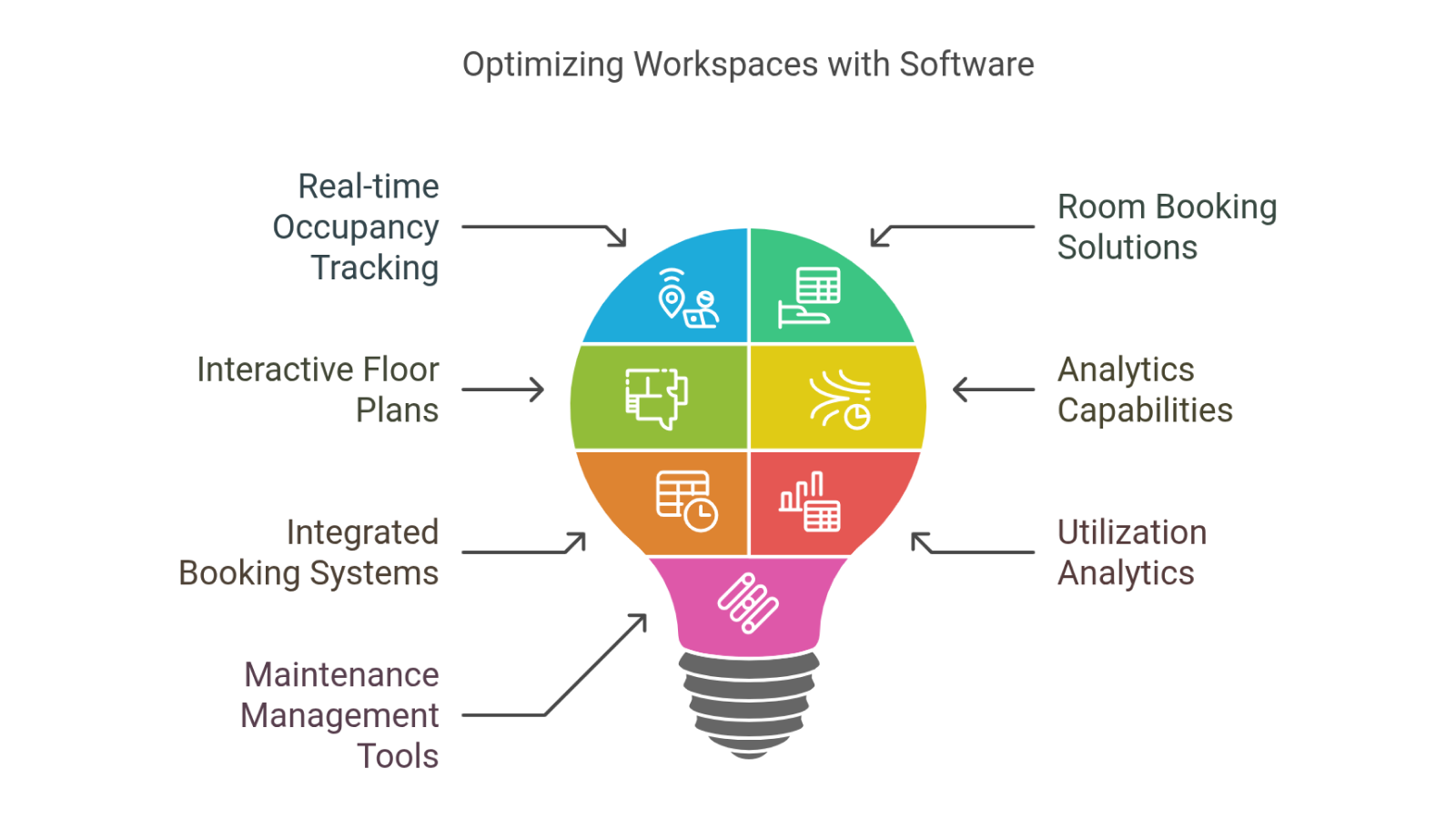

Modern space planning software provides powerful tools for optimizing workplace efficiency and involves tracking real-time data across facilities. These platforms typically include real-time occupancy tracking, room booking solutions, interactive floor plans, and sophisticated analytics capabilities that transform raw data into actionable insights.

This type of software can help organizations plan and manage their spaces through integrated booking systems for desks and meeting rooms, utilization analytics, and maintenance management tools. The best space management tools offer comprehensive workplace monitoring while integrating seamlessly with existing technologies and providing scalable options for future growth.

Metrics for Success in Space Management 📊

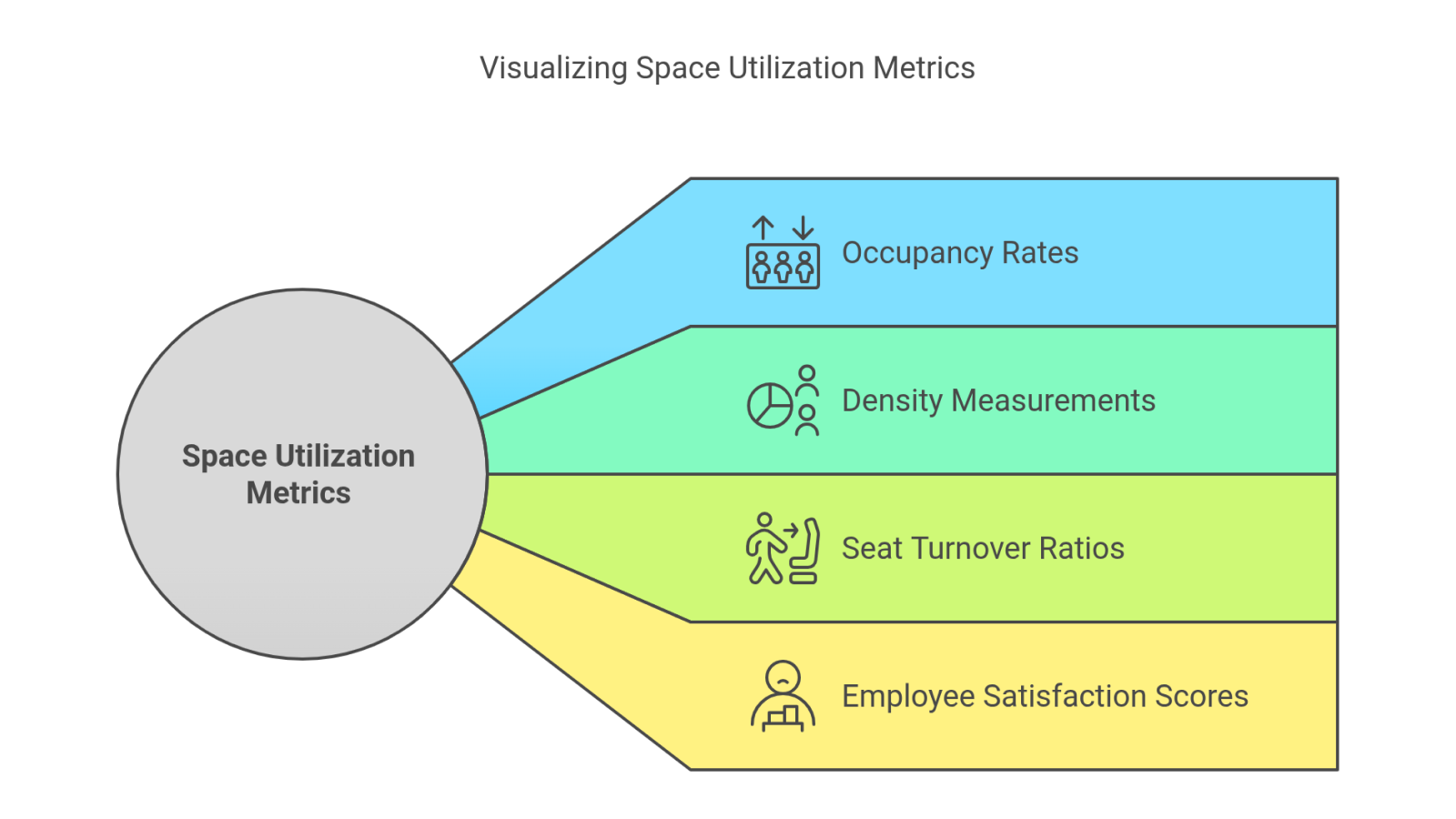

Measuring space utilization forms the cornerstone of managing space. Key metrics, gathered through space utilization sensors, include occupancy rates, density measurements, and seat turnover ratios, which provide crucial insights into how employees use space throughout their workday.

Regular monitoring of these metrics, combined with employee satisfaction surveys, helps organizations optimize their spaces continuously. Success indicators typically include improved occupancy rates (targeting 85-90%), reduced cost per square foot, and enhanced employee satisfaction scores.

Implementing Effective Space Management

Step-by-Step Process 📋

Implementing a successful space management plan requires a systematic approach. Here's a step-by-step process to guide your efforts:

- Audit current spaces:

- Document existing floor plans and space usage

- Identify immediate inefficiencies through walkthroughs

- Document existing floor plans and space usage

- Assess needs and set goals:

- Gather stakeholder input on space requirements

- Define measurable objectives aligned with business strategy

- Gather stakeholder input on space requirements

- Develop optimization strategies:

- Consider flexible workplace options (hot desking, activity-based working)

- Plan layout improvements for better workflow

- Consider flexible workplace options (hot desking, activity-based working)

- Implement support systems:

- Deploy space management software solutions and tracking tools

- Train employees on new systems and processes

- Deploy space management software solutions and tracking tools

- Monitor and adjust:

- Track utilization metrics and gather feedback

- Make continuous improvements based on data

- Track utilization metrics and gather feedback

Consider these tips for immediate improvements:

- Convert underused spaces into collaborative areas

- Implement flexible seating arrangements

- Digitize files to reduce storage needs

- Improve workspace navigation and signage

Overcoming Challenges

Implementing new space management initiatives often faces resistance from employees accustomed to traditional work settings.

Success Strategies:

- Clear Communication

- Share reasons, benefits, and timeline for changes

- Keep updates flowing regularly

- Share reasons, benefits, and timeline for changes

- Employee Engagement

- Gather input through surveys and focus groups

- Include staff in planning process

- Gather input through surveys and focus groups

- Support System

- Provide thorough training

- Assign team champions to guide others

- Provide thorough training

- Gradual Implementation

- Start with small pilot program

- Refine approach based on feedback

- Start with small pilot program

- Recognition

- Share positive results and metrics

- Build momentum through success stories

- Share positive results and metrics

Space management software helps make better decisions by analyzing space data and identifying opportunities to improve workspace efficiency. Celebrating early wins and sharing positive metrics helps build momentum and support for space management initiatives.

Emerging Trends in Space Management

Sustainability Goals

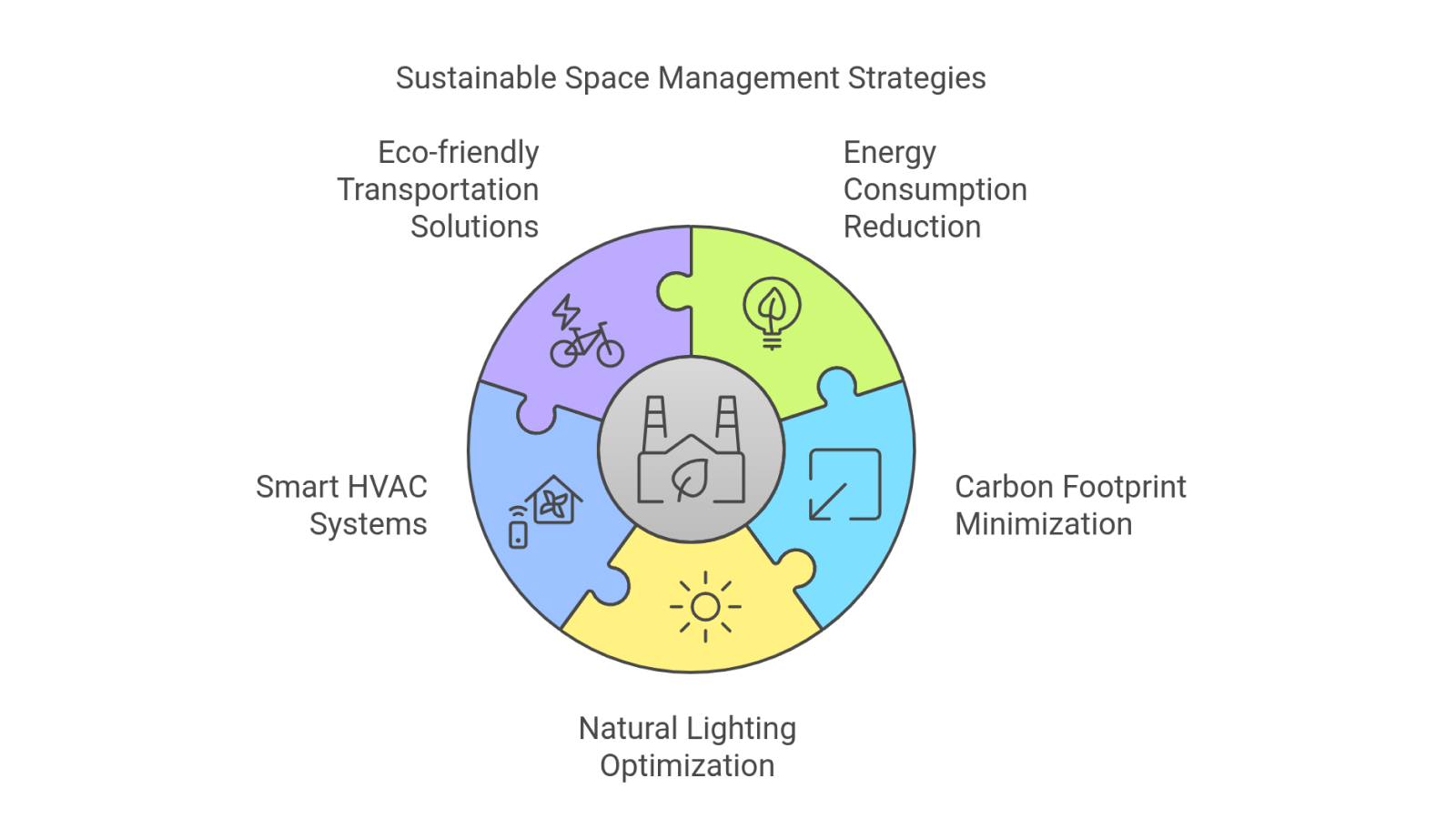

Benefits of space management increasingly align with environmental responsibility goals. Smart space utilization reduces energy consumption and carbon footprints while supporting sustainable office practices.

Modern strategic approach to space management incorporates natural lighting optimization, smart HVAC systems, and eco-friendly transportation solutions. These initiatives typically result in significant energy savings while enhancing workplace comfort and environmental impact.

Hybrid and Flexible Workspaces

Space management has evolved to support the growing demand for flexible work arrangements. Today's workspaces must accommodate hybrid schedules while maintaining productivity and collaboration.

Elements of space management include hot desking and room booking systems, collaboration zones, and quiet areas for focused work. Success requires robust computer-aided facility management and clear policies that support both in-office and remote work patterns.

Conclusion

Smart space management has become essential for modern organizations seeking to optimize their workplace environments. Through strategic planning and implementation, organizations can create more efficient, sustainable, and engaging workspaces while reducing operational costs.

The future of facility management lies in adaptive space management solutions that support evolving work patterns and organizational needs. By embracing these principles and technologies, organizations can create workspaces that drive success while supporting employee wellbeing and satisfaction.